At the moment, sustainable proteins are where solar panels were in the early 1990s. They exist and are available to eco-conscious consumers who are willing to pay more, but need investment in order to improve quality and reduce prices.

As of today, there are notable differences between the situation in the US and Europe. Good Food Institute reports a 24% increase in European funding for alternative proteins by 2022, while that of US companies fell by 63%.

European alternative protein companies raised €579 million in 2022 and the European plant-based sector saw a 15% increase in venture capital deals, raising €284 million in 2022. (Gfi Europe, 2023. Pitchbook data).

However, global investment in sustainable proteins slowed last year, from a record €4.7bn in 2021 to €2.7bn in 2022, reflecting the sharp decline in venture capital investment overall. In the first quarter of 2023, investment in alternative proteins has continued to decline, with the main reasons for this, as in other industries, being higher oil prices, rising interest rates and inflationary pressures.

According to Forward Fooding, the plant-based category is becoming saturated (there are more than 900 companies globally), making it difficult for new players to enter and grow their market share. Investment in alternative protein has shifted towards proteins made using fermentation and cellular agriculture technologies, which have already reached the same level of investment as plant-based (€3.2B in the period 2021-2022).

2021 marked the beginning of this trend, as, for the first time, less money flowed into plant-based companies compared to fermentation and cellular agriculture as a whole. Many fermentation-based, cell-based and hybrid products have yet to gain significant market share.

In addition to this, several investors have expressed doubts about the real opportunity represented by the vegetable protein market, as growth expectations for this category have been overestimated and the sector is, according to several experts, going through the “disillusionment phase” of the Gartner’s Hype Cycle. What is clear is that the sector is immersed in a phase of adaptation in which it is trying to understand its place, adapt to new market demands and consolidate itself.

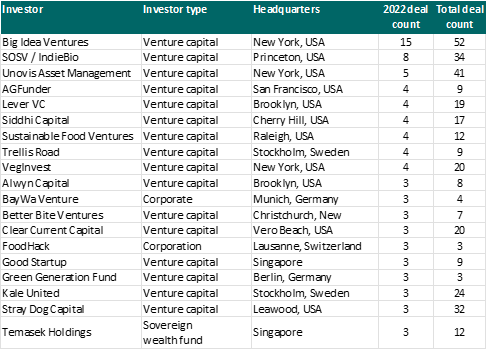

Major global plant based investors

The following table shows a list of the most active investors in the plant based sector by number of transactions in 2022: